Thanks for reading or listening! If you enjoyed this post, show your support by liking and sharing, buying me a coffee, or subscribing!

I’m generally interested in a lot of topics in international relations, but most of my published research falls in the genre of international development. I therefore like to keep my hear to the ground for the latest news in the international development space, which means that I subscribe to the Devex daily Newswire.

I bookmarked a recent newswire that came out on June 25 because I thought its headline story would be worth writing a post about: that the world’s governments are drowning in debt. I’ve talked about U.S. debt before, but the U.S. isn’t alone in dealing with a massive debt burden. But is the problem really bad enough to say that the world is “drowning” in debt? I decided to take a look at the data to see for myself.

I turned to the Global Macro Database,. which has become my go-to source on macro-economic indicators. It tracks, among many things, government debt and instances of sovereign debt crises — instances where a government defaults on its debts.

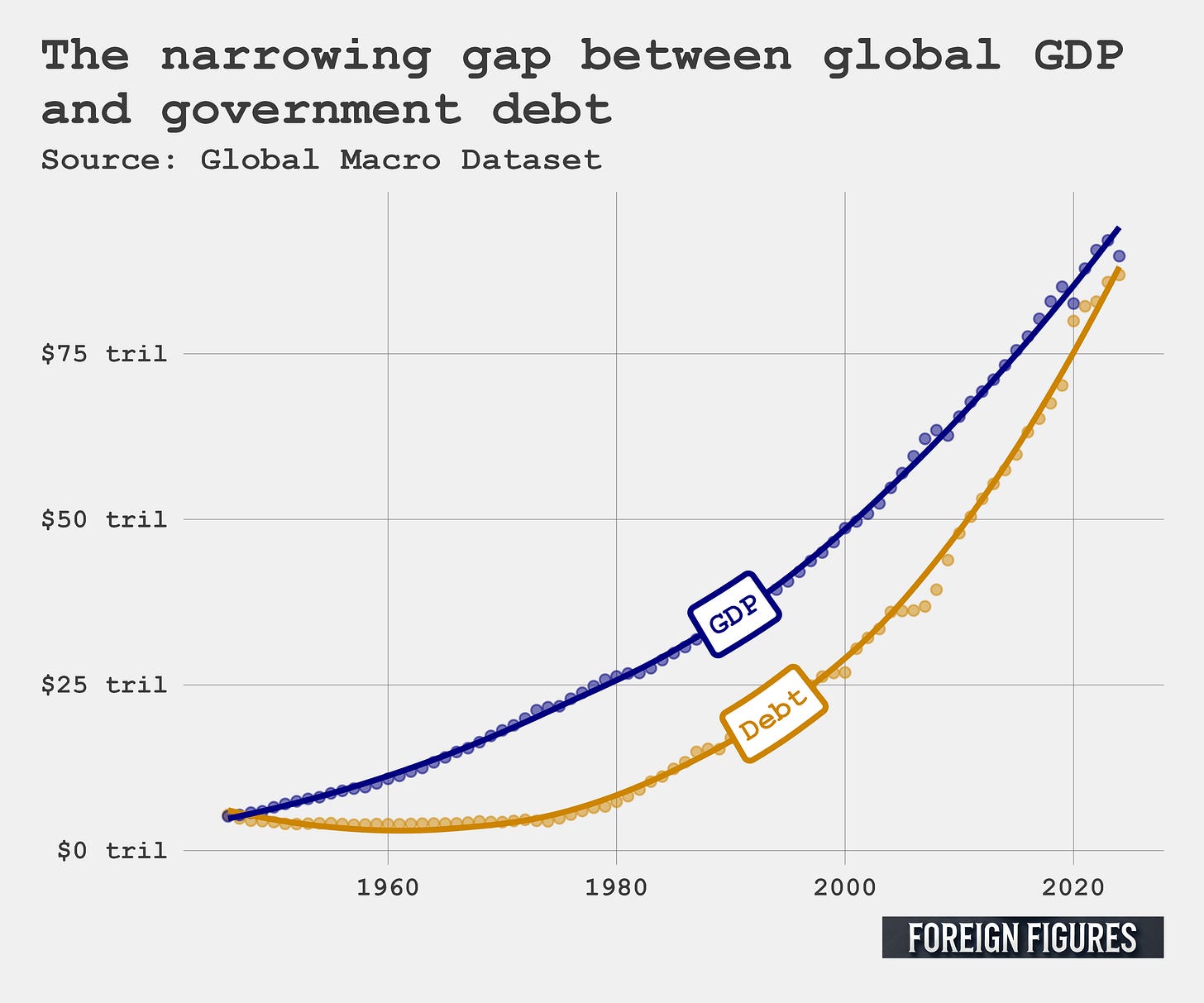

Two trends pop out in the data. The first is that the world really is drowning in debt. I put together two figures to show how bad the problem is. The first shows the global total for real gross domestic product (GDP) in trillions of U.S. dollars alongside global government debt (adjusted to ensure values are comparable to real GDP) by year from 1946 to 2024. Both GDP and debt have been growing in tandem, and at an exponential rate. In 1946, real GDP was over $5 trillion, as was global debt. In 2024, real GDP nearly reached $90 trillion and global debt reached nearly $87 trillion.

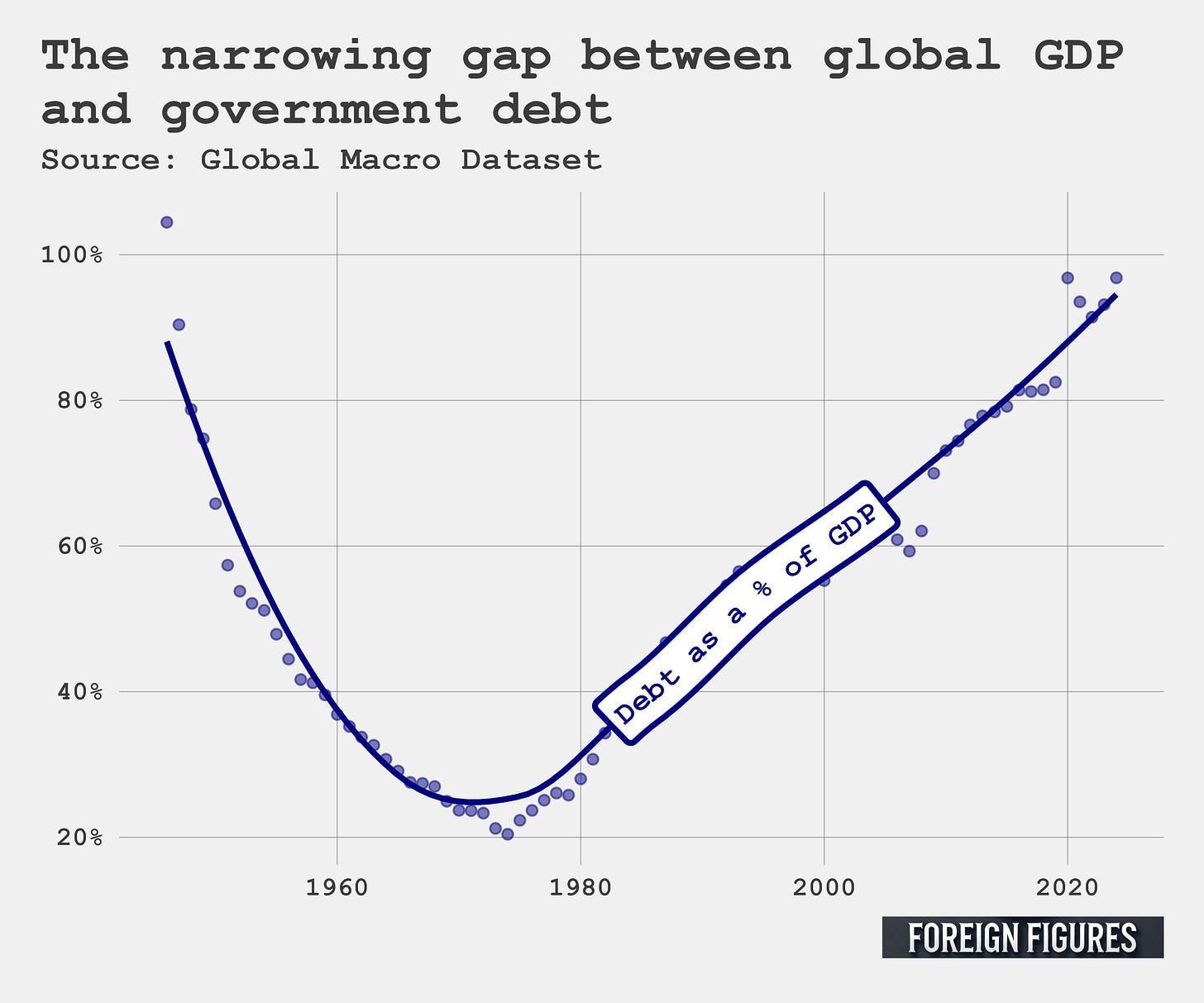

The next figure I made better shows how much global debt has increased relative to GDP. In 1946, global debt was greater than global GDP, totaling over 100%. That’s no surprise since the world just experienced World War II. From 1946 until the mid-1970s debt as a share of GDP declined on a yearly basis, reaching a low of nearly 20% in 1974. The trend then takes an immediate 180, increasing nearly every year thereafter. By 2024, debt as a share of GDP reached 96% — the highest it’s been since World War II. COVID-19 certainly played its role in spiking global government debt — 2020 was nearly as bad as 2024 — but the trend had been in an upward accent long before COVID hit the stage.

Okay, what about the second trend I mentioned that I saw in the data? Surprisingly, while global debt is on the rise, the incidence of debt crises is trending downward, as you can see in the figure below. The percentage of countries in the world that experienced a sovereign debt crisis reached its peak in the early 1990s, with over 8% of governments defaulting on their debts. In 2020, the last year data was available in the Global Macro Database, zero countries suffered such a crisis. Neither did any in the preceding two years, and the overall trend since the early 1990s has been downward. This finding seems counterintuitive, but it has a simple explanation: in the 1990s there was a global effort to reform the global debt system coupled with a massive round of debt relief for some of the most heavily indebted countries.

So what does the future hold as the world seems poised for another global debt crisis? My guess is that there will be another round of debt relief. But in the meantime, the problem is going to persist, and I wouldn’t be surprised if global debt exceeds global GDP before the next decade.

And why exactly is that a problem? Simply put, all this debt means countries, particularly the poorest and most vulnerable, have debt burdens that exceed what they can spend on their own development and social safety nets. This problem is only going to be exacerbated by America’s retreat from its foreign aid programs, and by a global decline in foreign aid spending.

In a globalized world, these problems will not be constrained by national borders.

Code to replicate the figures in this post can be found here.

Thanks for reading! If you enjoyed this post, show your support by liking and sharing, buying me a coffee, or subscribing!